Personal loans and student loans are typically unsecured loans. These loans tend to have stricter borrowing requirements, lower borrowing limits and higher interest rates. Home equity loans and auto loans are typically secured loans.Īn unsecured loan does not require collateral, making it a safer option, especially if you have good credit and can qualify for the best interest rates. However, because the lender is taking on less risk, these loans do tend to come with lower interest rates and better terms over all. These loans involve a great deal of risk since you could lose your asset if you do not pay the loan back. This is typically something like a house or vehicle. Secured loans require you to put up an asset as collateral. Loans come in secured and unsecured options. If you are having trouble qualifying for a federal loan, compare terms and rates on private student loans before choosing a lender, as these can vary widely.

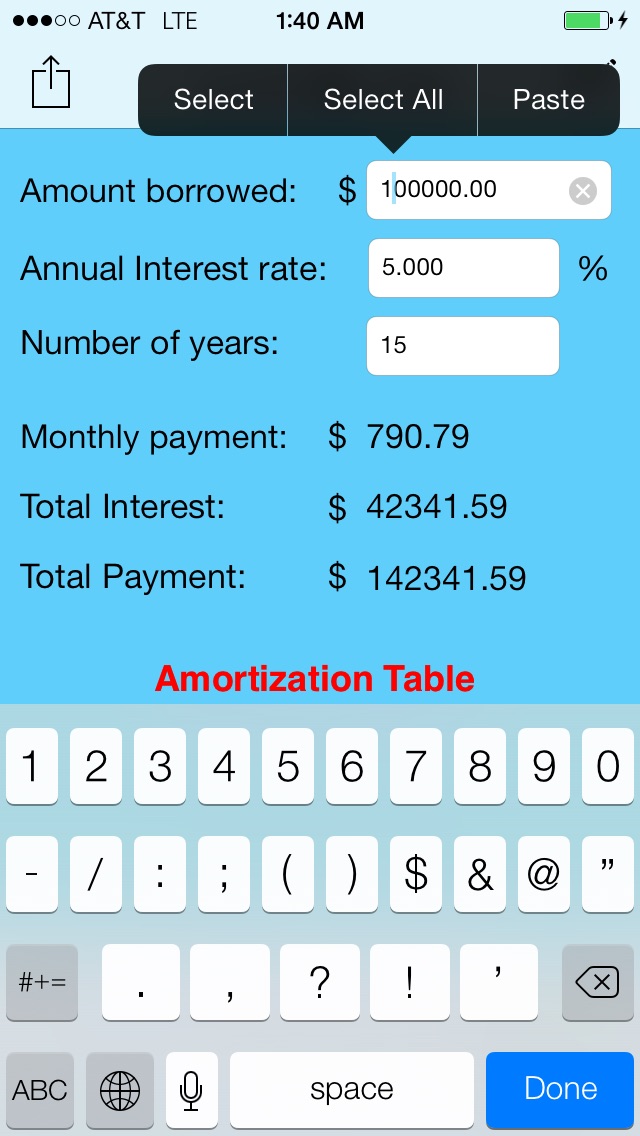

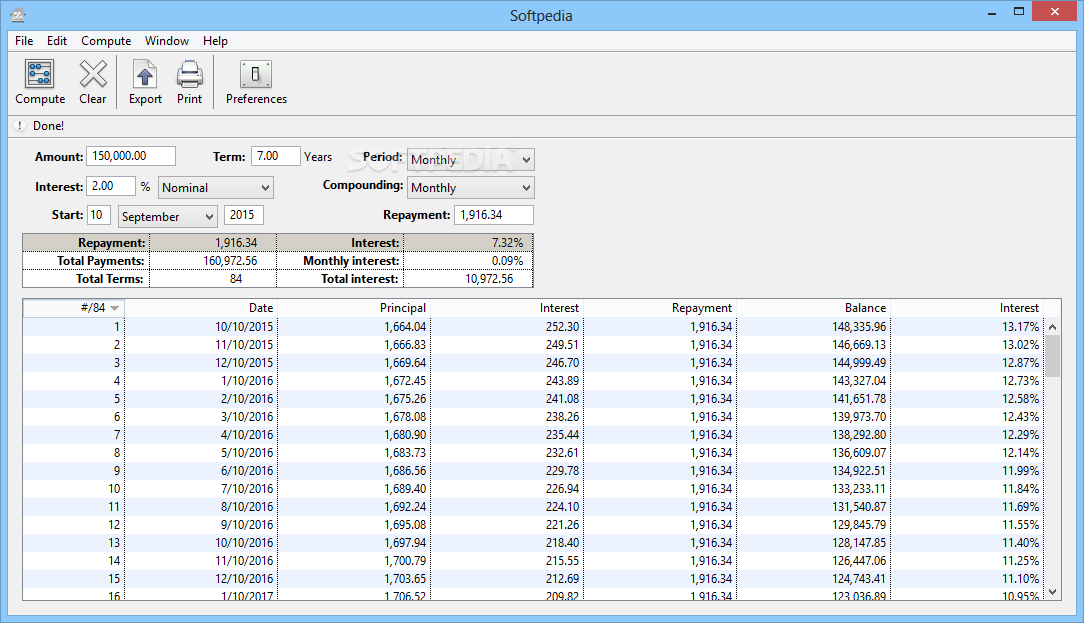

Federal student loans are generally better because they come with borrower protection and have standardized deferment and forbearance periods. There are both federal student loans and private student loans. Student loans are loans specifically for educational purposes.If you are in the market for a personal loan, compare top lenders to find the one with the best rate for your credit score. These loans have fixed interest rates and repayment terms that typically range between 2 to 5 years. Personal loans are sums of money you can borrow from a bank, credit union or online lender that can be used for virtually any purpose.However, they typically have better interest rates and terms than other loan products. These loans are secured and use your house as collateral, so you do run the risk of losing your home if you fail to make the payments. Home equity loans and home equity lines of credit are borrowed against the amount of equity you've built up in your home (the value of your home minus the amount you've paid down).Before applying, shop around to find the best rates and repayment terms to make sure the payments reasonably fit into your budget. Auto loans are secured loans, meaning that the eligibility requirements are less stringent than unsecured loans, but the vehicle is put up as collateral so if you fail to make payments, you could lose your vehicle. Similar to personal loans, auto loans allow you to borrow a lump sum and pay it back over a set repayment period with interest. Auto loans are loans intended to help finance a vehicle.When considering the type that's best for you, it's important to compare each option to make sure the loan will benefit you and your finances down the road. There are loans offered for nearly every legal purpose by a variety of lenders. For example, if you have an auto loan with a monthly payment of $500, your first month’s payment might break down into $350 toward interest and $150 toward the principal. Often, within the first few years, the bulk of your monthly payments will go toward interest. In the context of a loan, amortization is when you pay off a debt on a regular, fixed schedule. If you would prefer a loan payment calculator that delves into the granular details (such as amortization), use our more robust calculator. Because this is a simple loan payment calculator, we cover amortization behind the scenes.

The Bankrate loan payment calculator breaks down your principal balance by month and applies the interest rate you provide.

0 kommentar(er)

0 kommentar(er)